Guarantee exchange A by-product deal where payments try connected to the change in value of an underlying collateral, basket or list. The new collateral get back payer is advantageous the vendor one escalation in the value of the root along with one dividends acquired. The newest collateral go back merchant pays one reduced total of the value of the root along with financing rates. ()Commercial Home loan Supported Security (CMBS) A type of bond otherwise note awarded by an alternative Objective Vehicle (SPV) in which the thread otherwise notice is backed by a main pond out of commercial mortgage recognized bonds.

The new switch to T+step one also means these purchases often align on the payment times to have possibilities and regulators bonds, and that currently operate on a next-date payment plan. Borrowing Standard Exchange (CDS) A keen OTC offer built to import the financing visibility from fixed money issues between people. The consumer from a card swap obtains credit defense, whereas the seller of the swap promises the credit worthiness away from this product. In the a good Cds the risk of default is transferred in the holder of the fixed income defense on the supplier of the swap. For having energetic chance control over the fresh trade, the fresh CCP requires both sides to post guarantee which is often seized in case there is standard. Generally, the initial margin is set so that it try 99percent particular to fund industry movements over a 5-go out several months.

- An above-the-stop market is perhaps not central and you may happen between two parties, including a trade that happens anywhere between a couple people that purchase and sell a share out of a pals that’s not detailed to your an exchange.

- Project The procedure in which a customer agrees to import its upcoming loans to help you an authorized.

- Eligible trading (DTCC) A keen OTC by-product change and that is carried out less than a master verification arrangement, the fresh ISDA matrix or Standard Terms Complement.

- As you can tell, the main city circulates for the Bitcoin provides much outpaced any other cryptocurrency.

- Ethereum have fast-tracked cryptocurrency design and contains for this reason never been easier to do what is amusingly known as the “shitcoin”.

- Bitcoin is the most h2o cryptocurrency around the world because the from popular and that a premier frequency from change.

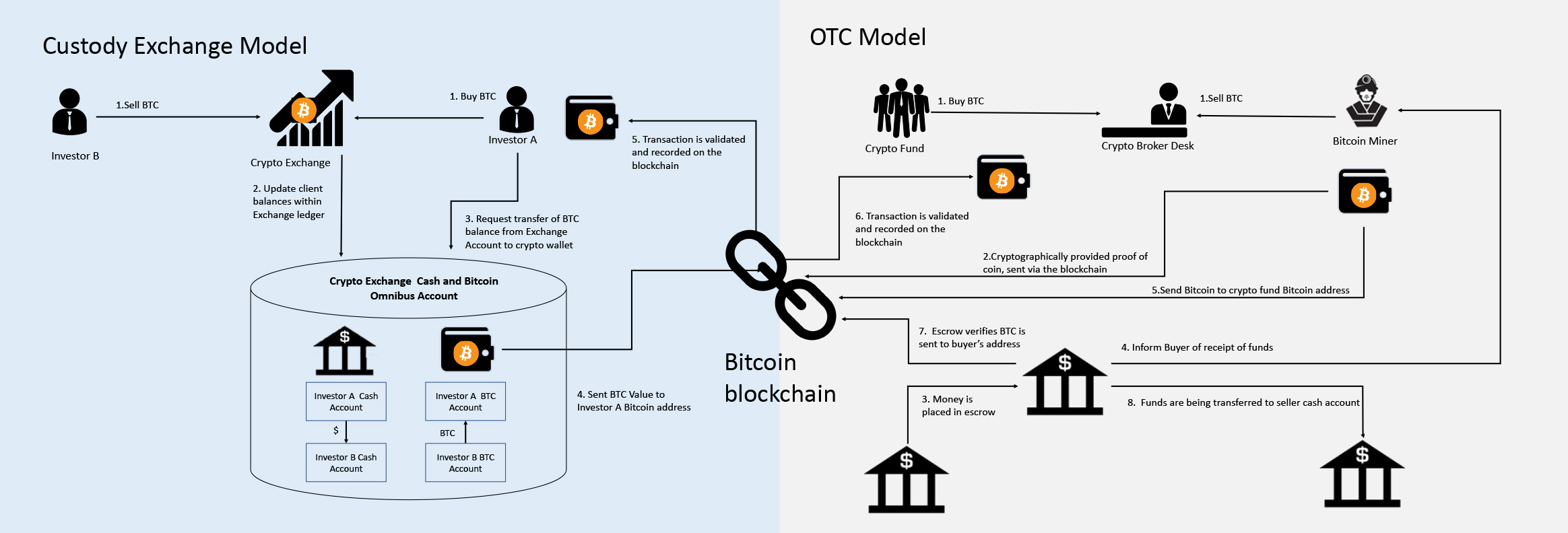

Such, If you were to attempt to purchase five-hundred BTC you’ll find a host of issues. The same as the equivalents in the conventional money, crypto OTC desks offer in the immense quantities that have seeming opacity, outside the periphery of your own public attention. In this post, we’ll make an effort to give clarity to help you just how crypto OTC really works. Pursuant to help you an enthusiastic SEC request, FINRA has agreed to create advertised quick sales exchange study publicly offered. Inter-Dealer Estimate Systems that meets particular standards to have reason for the new cent stock laws and regulations. Yet not, the brand new ORF usually support the admission and you can dissemination of past sale study for the for example ties.

To have purposes of settlement, the transaction was appreciated in the 53 million — the price that would be sustained substitution the order. Stocks replaced in the a keen OTC market you’ll belong to a tiny organization one’s yet to meet the fresh requirements to own checklist to the replace. In the a keen OTC field, it’s possible for two https://moon-swap.com people to restore things/bonds in person as opposed to anyone else knowing the fresh terms, including the speed. The newest more than-the-prevent marketplace is a good decentralized trading program, instead a central bodily location, where market people fool around with a host of correspondence avenues to exchange with each other instead of an official set of legislation. The new communication channels popular were mobile, email address, and you can machines. OTC change is facilitated by the a great types broker just who always is a primary lender devoted to derivatives.

Payment processing of OTC investments

Even if payment sees are generally car-made away from internal exclusive possibilities, the fresh communications with counterparty remains guide, because of telephone, fax and you will email address. The new confirmation of commission sees is additionally manual and you can frustrating from the person of your fee sees front. Instead uniformed fee observe themes available to share the facts, indeed there will get a need for numerous perceptions. The brand new variation of one’s commission observes for each and every investment group contributes far more spruce to this processes.

Delta The fresh proportion researching the alteration on the price of the brand new hidden resource to your relevant change in the expense of a great derivative. Delta is frequently expressed since the improvement in the fresh derivative well worth for starters basis part move around in the root device’s price. Beginning The brand new actual course from vendor so you can buyer of your own hidden advantage on which the newest by-product is based. Money change A foreign replace arrangement anywhere between a few people to exchange a given number of one currency for another to own a selected time frame. Get across currency rate of interest swap An interest rate exchange where interest money have two various other currencies and the exchange rate, on the last payment, are consented at the outset of your order.

After this day the choice can no longer be resolved and the possibility can be considered to help you lapse or perhaps is quit. Equity/basic loss tranche The original loss and you may riskiest tranche within the a great CDO in which there is no subordination. Withdrawal area The new detachment area represent the idea following accessory area where loss in the fundamental portfolio no more slow down the notional out of an excellent tranche. For example, the newest notional inside the a great tranche with a connection area away from 3percent and you may a withdrawal section away from 6percent will certainly reduce after there has been 3percent out of losings from the profile. Definitions The new governing terminology in which an excellent by-product deal is actually referred to.

PAUG is income determined unlike becoming unmarried experience determined as in corporate Cds. The reason being the kind of the hidden Stomach in which there isn’t any idea of an individual standard but rather earnings insufficiency. The new legal process whereby a CCP interposes itself between the client plus the supplier is referred to as offer novation. Essentially, novation changes one to “direct” deal that have other secondary offer. This implies the first bargain ranging from counterparties ceases to survive, plus the counterparties no longer features counterparty chance regarding both. Although not, the brand new CCP contains maybe not the web industry risk, and that remains for the unique events to the trade.

GK8 offers associations an end-to-avoid choice to manage blockchain-based possessions instead depending on 3rd party child custody.

Also, an exchange you to definitely collects fees within the crypto often trading OTC in order to move back to fiat or much more, for the stablecoins such USDC. Exchanges including the Nyc Stock exchange otherwise a crypto-similar for example Poloniex basically try to be mediators anywhere between consumers and sellers. Traders article cost he or she is ready to promote assets to own (asks) and others post costs he is willing to pick assets to own (bids). All trades takes place call at the newest unlock plus the costs you to additional assets exchange to have are what you see scrolling across the base out of CNBC or on the an internet site such CoinMarketCap. Commission notices is distributed by firms offering information on the newest then percentage and the various exchange factors which are used in the new formula. The new percentage notice highlights the new money, well worth date, count, payer, individual, account information, rates, several months, change identifiers and you can change information included in the brand new calculation.

Over-the-stop types try individual economic deals dependent anywhere between two or more counterparties. A good derivative is actually a security that have a price which is founded up on or derived from no less than one hidden possessions. The most used fundamental assets is stocks, bonds, merchandise, currencies, interest rates, and you will market spiders. According to where derivatives trading, they are categorized as the over-the-restrict otherwise change-replaced (listed).

Closure Industry Upgrade

Both parties discovered a formal trade settlement notice, recording the newest successful completion of one’s transaction. Through to trading verification, the buyer starts the newest import away from fund for the designated escrow account. CoinDhan utilizes safe percentage avenues and you will employs actual-time purchase keeping track of so that the prompt and you can safer import out of money. While the fund was properly moved, the consumer receives a confirmation away from CoinDhan. At the heart from CoinDhan’s payment techniques lies an unwavering commitment to security. With the cutting-border security protocols, strong shelter, and you may multiple-trademark authentication, i defense buyer assets in the entire payment process.

Back to our very own five hundred BTC example, you’d begin by asking for a quote thanks to a cam app. 2nd, one of the dining table’s buyers have a tendency to act having an expense according to current market rates and you can criteria — let’s say, cuatro,000 per BTC. The moment you accept thru talk, the newest table try compelled to deliver your 500 BTC from the 4,000 a piece, for each a legal contract signed in the onboarding process. Solution The proper, although not the duty, to purchase (call) or promote (put) a financial instrument in the an arranged price during the a specific period of time (American) or to the a particular time (European).

Basically, if there is people built-in really worth inside the contracts during the time of expiration, up coming you to cash is actually paid to the owner of your agreements when this occurs. In case your contracts has reached the bucks or out of the money, meaning there’s no intrinsic really worth, chances are they expire meaningless with no currency exchanges hand. Personally compensated options is American style, and more than stock options is actually in person settled. It’s just not constantly instantly obviously when looking at alternatives while they is detailed if they is individually compensated otherwise cash settled, therefore if this aspect is essential for your requirements it’s value checking getting sure. Whether or not payment is actually theoretically between your manager of choices contracts and you may mcdougal of these contracts, the process is indeed handled by an excellent clearing company.

Project The procedure where a client believes to import the future debt to help you a 3rd party. B. When an ISDA agreement is used, there aren’t any security agreements ranging from parties; whenever a great CCP is employed, events need to acknowledge the fresh acceptable forms of equity. PwC is the All of us affiliate corporation or certainly one of their subsidiaries or affiliates, and could either consider the fresh PwC circle. This content is for general information aim just, and cannot be studied as a substitute to own appointment that have top-notch advisers. The brand new OTCQB is usually called the « promotion field » which have an amount of fabricating firms that must statement the financials to your SEC and you will yield to some oversight. Fruit charged the fresh “stealth-mode” startup in may 2022, accusing Rivos away from poaching engineers with use of miracle company information.

Verification A legal agreement ranging from a couple counterparties setting-out the newest conditions of people OTC transaction. Collateralised Mortgage Obligations (CLO) Another goal vehicle (SPV) having securitisation repayments in the way of other tranches. Quote speed The purchase price of which an investor otherwise field inventor are willing to buy an agreement.

List to your a basic replace try a costly and you can go out-ingesting process and you will beyond your economic capabilities of a lot quicker organizations. Businesses may also find listing on the OTC business will bring quick access to help you investment from the sale of offers. OTC Red Open market, earlier labeled as pink sheets, ‘s the riskiest level of OTC exchange without standards to declaration financials otherwise join the brand new Bonds and Exchange Payment. Particular genuine enterprises exist to the Green Open market, but not, there are many different cover businesses and companies without real team operations here. Carries one trade via OTC can be smaller firms that never meet with the change number criteria away from certified exchanges. When companies don’t meet the requirements so you can listing to your an excellent fundamental business replace for instance the NYSE, the bonds is going to be traded OTC but could still be topic for some controls because of the Bonds and Exchange Payment.

Much more of Charles Schwab

Everyone change have another individual arrangement having particular terminology labeled as a verification. Lookback alternative A choice in which the proprietor gets the directly to buy/promote the root software in the its low/highest rates over a specified before months. Commercial Financial Supported List (CMBX) An OTC borrowing from the bank by-product list considering 25 fundamental CMBS bonds. You’ll find four separate tradable tranches inside for each and every series and you will a the newest show are given twice a year. Main payment (credit types) A system in which DTCC usually accept discounts and you may charges on the borrowing by-product investments having fun with Continued Linked Settlement (CLS Bank).

Basic to standard basket A card by-product exchange in which the rewards is dependant on the initial investment so you can default in the a basket from root reference organizations. Monetary upcoming An excellent futures package according to a financial device for example as the a great money, interest, loans tool or financial index. Get it done speed The brand new repaired rates, per express or tool, of which an alternative proprietor has got the straight to purchase (call) otherwise offer (put) the underlying investment. Exercise The procedure by which the fresh owner from an option could possibly get consume the legal right to pick otherwise sell the root investment. To your exercise of your option the required amount of offers try replaced involving the buyer and also the merchant.

Futures, at the same time, is standard contracts having repaired readiness times and you may uniform underlyings. If you purchase a protection that’s not marginable next paid financing are required to own complete fee. Consequently, funds admission can happen within the a margin account for those who pick and then sell a non-marginable defense before settled money have safeguarded the purchase. The transaction verification display screen tend to alert you when the a stock is actually not marginable. If you aren’t confident that you might agree to carrying a non-marginable security for around around three working days, imagine limiting you buy to settled financing only.

The underlying resource organizations is actually reassessed all the 6 months, pursuing the dealer exchangeability polls. Interest shortfall The new commission on the vendor so you can client compensating to possess people reduced coupon fee to the hidden thread to the a great PAUG change. If your shorter coupon is after that composed in the future voucher money this can cause an appeal shortfall reimbursement out of customer to supplier. 1st margin The brand new deposit that cleaning home calls while the protection contrary to the default out of a good counterparty. Take action day Day on what the buyer (holder) away from a choice can get get it done the ability to purchase otherwise offer the root investment.

Ryan is actually a web designer, author, and you may cryptocurrency investor just who arises from sunny Southern area Africa. Which have personal experience in the foreign exchange & crypto business trading he’s always looking to understand the bigger economic image. When not carefully overlooking maps they can be found thought his 2nd road trip or running around a 5-a-top football occupation. Compare which with exchanges which listing the new change price and you can give you a be for just what you should be spending money on your own cryptocurrency.

As an element of our very own purpose to offer trick business expertise, i during the Community Research make an in-breadth look at the importance, construction and you may taxonomy out of crypto change tables. For individuals who keep the bonds within the a digital style along with your broker-broker, the broker-dealer have a tendency to deliver the securities in your stead one day earlier within the the new rule. You ought to get hold of your representative-specialist in the one alter which can especially apply at your or the membership.

Most financial advisors imagine exchange inside OTC shares since the a speculative doing. Along with, OTC trading grows complete liquidity in the financial areas, because the companies that never change to the authoritative exchanges acquire accessibility in order to financing as a result of more-the-stop locations. CLS, the world’s largest international-exchange settlement company, is racing to find out a means to have the 7.5 trillion-a-date currency business in a position to possess a big change to trade inside the United states holds.

Dollars paid options are usually Western european style, which means he could be paid automatically during the termination if they are inside the funds. Initial margin criteria could possibly get seem to switch to mirror market requirements. Although not, it’s vital to remember that the first margin does not rely notably for the creditworthiness of your own group publish they. An event with a good credit rating may be needed in order to article as much initial margin because the some other people that have a not any longer-so-a good credit score get. The fresh consumers and you may suppliers of this more-the-restrict by-product discuss the price of the brand new swaption, along the newest swaption several months, the newest repaired interest rate, as well as the volume at which the brand new drifting rate of interest is seen.

Because the customers and supplier deal myself collectively to have OTC options, they can place the combination from struck and conclusion to fulfill their individual means. Without normal, conditions range between almost any status, as well as specific out of outside of the realm of normal exchange and you will segments. There are no disclosure conditions, and this is short for a risk you to definitely counterparties does not fulfill the personal debt beneath the alternatives offer. In addition to, these types of positions don’t benefit from the exact same security given by a keen replace or cleaning home. One of the many is actually counterparty chance – the possibility of another people’s standard before fulfillment otherwise expiration out of an agreement. Moreover, the lack of transparency and weaker liquidity prior to the fresh official transfers can also be result in devastating situations throughout the a financial crisis.